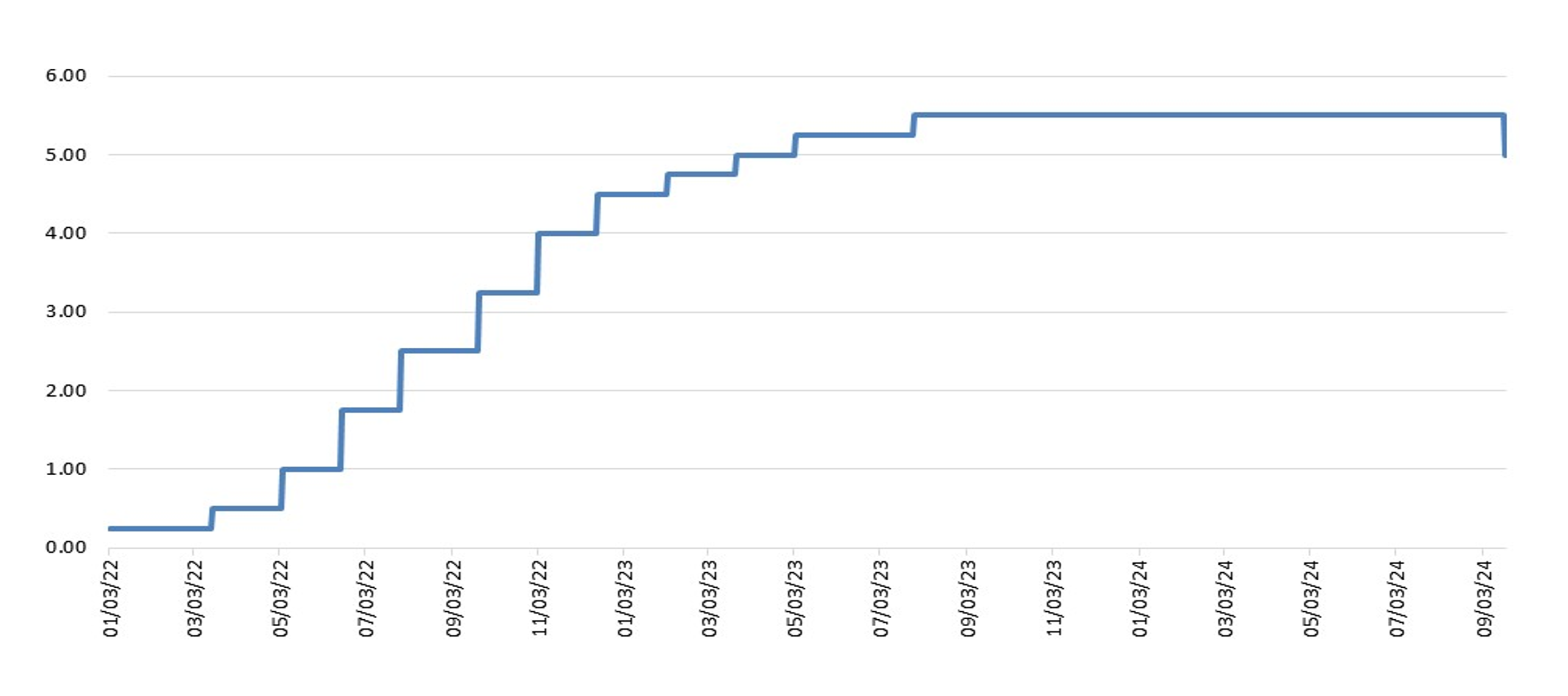

For over two years, the markets have pondered, bet and cajoled bond prices up and down in anticipation of whether and/or when the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) should or would cut interest rates. As in the play Waiting for Godot, it sometimes seemed as if that development might not happen.

On September 18, after a long 11-step hiking cycle, the Federal Reserve announced a 50-basis-point reduction in the Fed Funds Rate to a range of 4.75 percent to 5.0 percent.

U.S. Federal Funds Rate — Current Cycle

Source: U.S. Federal Reserve

Prior to the announcement, the Treasury futures market had projected an above-50 percent chance that the rate cut would be 50 as opposed to 25 basis points, essentially moving expectations toward the delivered 50 bps increase. The stock market reacted positively to the news, and the S&P 500® hit a record high the day after the announcement, with growth stocks leading the way.

According to the Federal Reserve statement issued along with the announcement of the drop in the rate, FOMC sees a “balanced” economy where inflation is under control and the labor picture is largely in sync:

The Committee has gained greater confidence that inflation is moving sustainably toward 2 percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance.

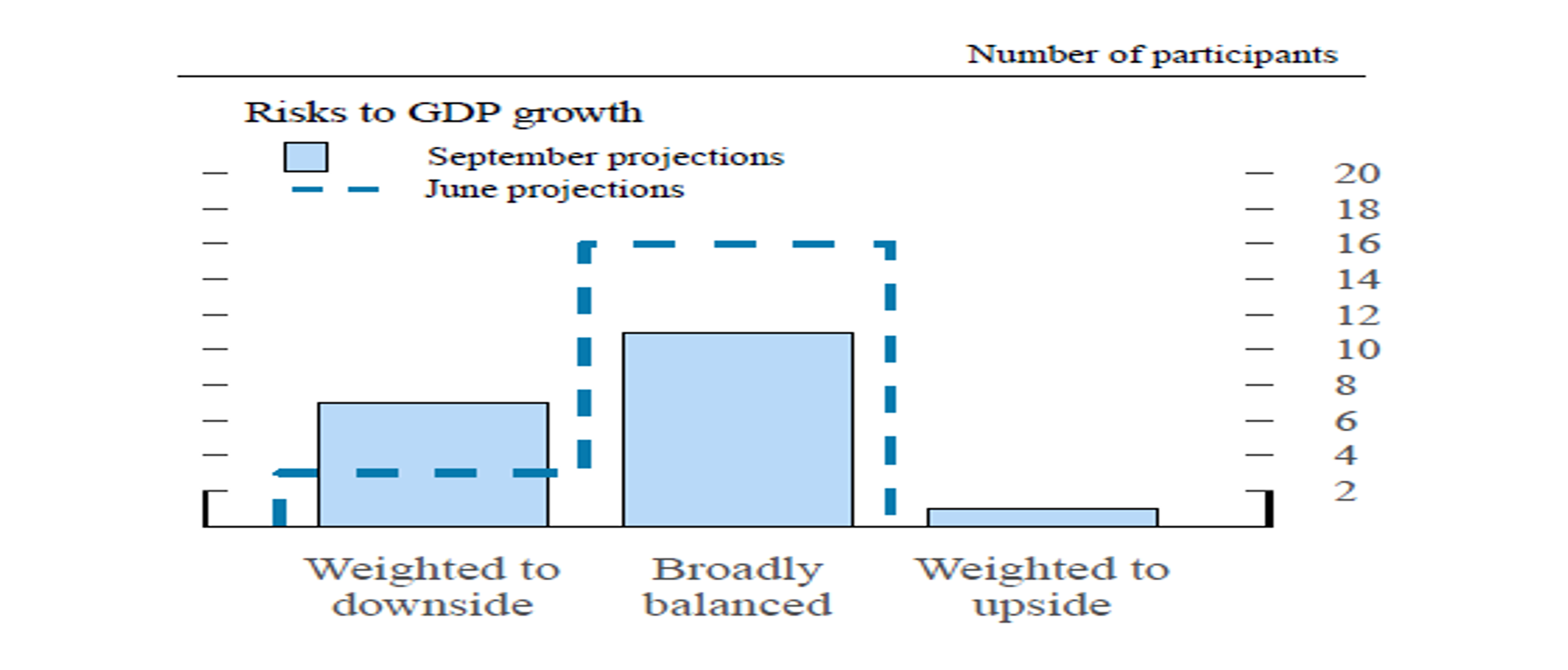

The Federal Reserve’s projections show that the Committee is largely in line with the “balanced” viewpoint. However, looking at their own projections below, they now see more downside risk to the economic outlook than upside, and more than in June. Likely this gave the Committee members more reason to cut 50 bps rather than the more typical 25 bps drop.

Federal Reserve Open Market Committee Projections as of September 18, 2024

Source: FOMC projections, 9/18/24

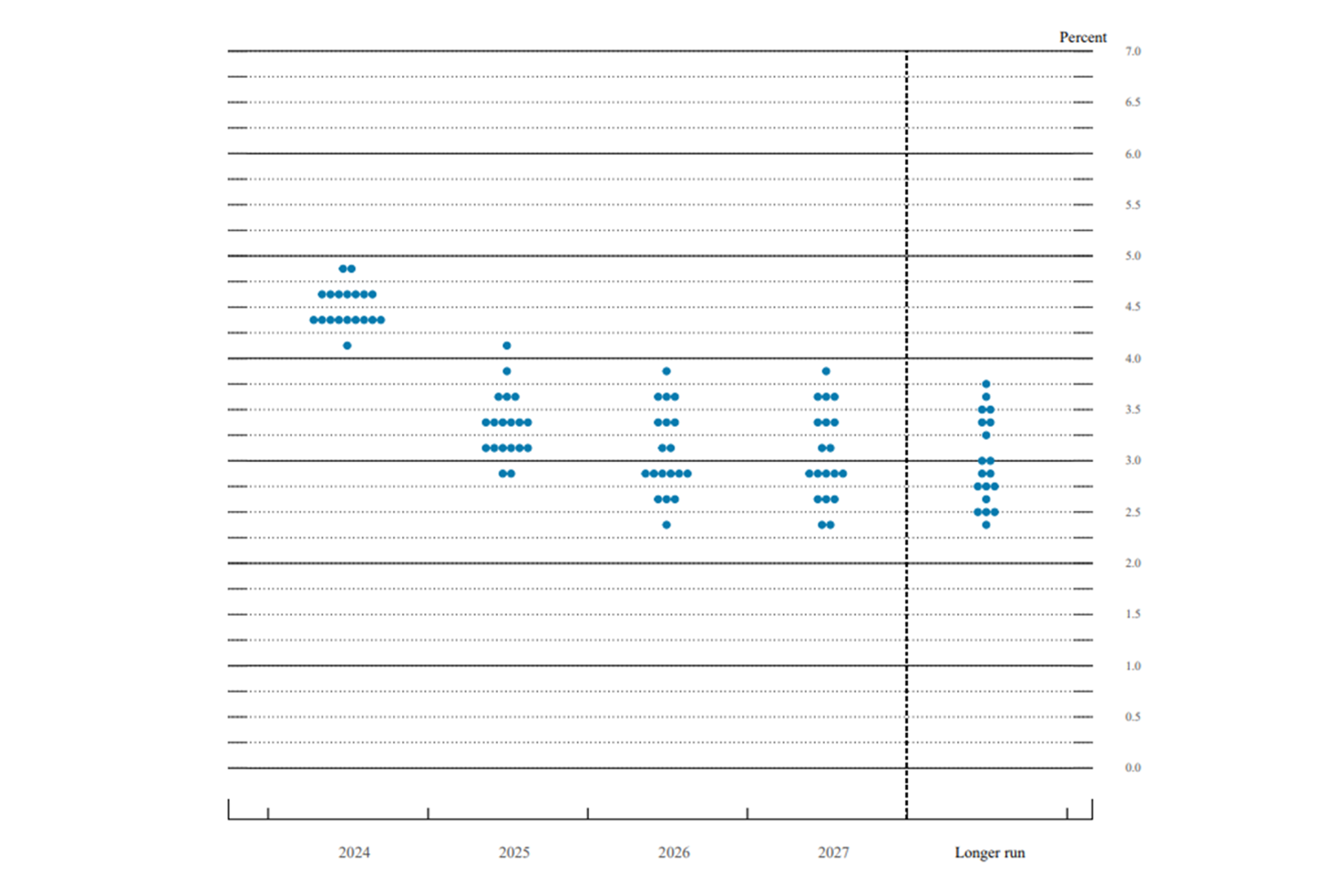

Looking ahead, the market projections on interest rates (since the FOMC meeting) are outlined below. As you will note, now that the Committee has opened the gates to rate cuts, the market is anticipating a fairly fast decline anticipating the Fed Funds Target rate getting to below 3.5 percent by 2025, which is not that far in the future. Time will tell if this happens, but history does tell us that once the cycle begins, barring black swans or extraneous forces, rates will continue lower. It is the pace that is a wildcard.

Fed Funds Rate Projections

Source: Factset

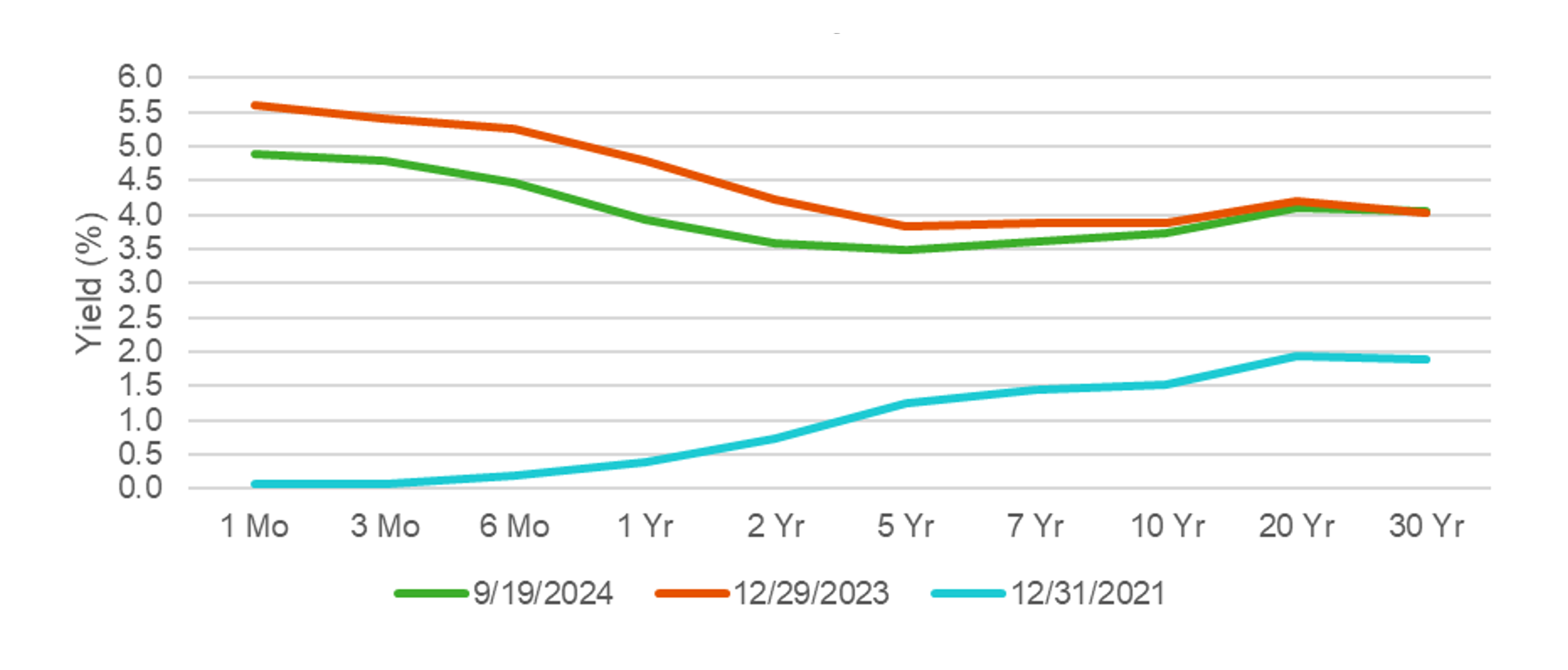

As a final reminder, we have come a long way in just three years (see the chart below) when short-term interest rates were zero.

U.S. Treasury Yield Curve

Source: U.S. Department of the Treasury

The waiting and debating, has caused bond prices to fluctuate dramatically over the last three years. Now that we are here, we look forward to, and hope that, yield, not price will provide the ballast for fixed income returns.

See more insights

August 2024: The Rollercoaster

July 2024 Market Update: Rotation?

State-Facilitated Retirement Savings Programs and Defined Contribution Plans

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.