The main event of September was the long-awaited Federal Reserve interest rate cut coming to pass. The 50-basis-points cut was greater than predicted even a month ago, but given modestly weaker labor data coupled with constructive inflation data, market-implied probabilities for a “jumbo” cut were up to over 65 percent the day prior. Not surprisingly, varied predictions are already flying about the next round of cuts. How many? How big? As Yogi Berra famously coined, seems like déjà vu, all over again.

September 2024 Investment Performance v. Year to Date Performance

| Equities | September 2024 (%) | Year to Date 2024 |

|---|---|---|

| All Cap U.S. Stocks |

|

|

| Russell 3000 | 2.1 | 20.6 |

| Growth | 2.8 | 24 |

| Value | 1.3 | 16.2 |

| Large Cap U.S. Stocks |

|

|

| S&P 500® | 2.1 | 22.1 |

|

Russell 1000 |

2.1 | 21.2 |

| Growth | 2.8 | 24.5 |

| Value | 1.4 | 16.7 |

|

Mid Cap U.S. Stocks |

|

|

|

S&P 400 |

1.2 | 13.5 |

|

Russell Midcap |

2.2 | 14.6 |

| Growth | 3.3 | 12.9 |

| Value | 1.9 | 15.1 |

| Small Cap U.S. Stocks |

|

|

| S&P 600 | 0.9 | 9.3 |

| Russell 2000 | 0.7 | 11.2 |

| Growth | 1.3 | 13.2 |

| Value | 0.1 | 9.2 |

| International |

|

|

| MSCI EAFE NR (USD) | 0.9 | 13 |

| MSCI EAFE NR (LOC) | -0.4 | 12 |

| MSCI EM NR (USD) | 6.7 | 16.9 |

| MSCI EM NR (LOC) | 5.6 | 18.3 |

| Fixed Income | September 2024 (%) | Year to Date 2024 |

|---|---|---|

| Bloomberg |

|

|

| U.S. Aggregate | 1.4 | 4.5 |

| U.S. Treasury: 1-3 Year | 0.8 | 4.1 |

| U.S. Treasury | 1.2 | 3.8 |

| U.S. Treasury Long | 2 | 2.4 |

| U.S. TIPS | 1.5 | 4.9 |

| U.S. Credit: 1-3 Year | 0.9 | 5 |

| U.S. Intermediate Credit | 1.3 | 5.6 |

| U.S. Credit | 1.7 | 5.2 |

| U.S. Intermediate G/C | 1.1 | 4.7 |

| U.S. Govt/Credit | 1.4 | 4.4 |

| U.S. Govt/Credit Long | 2.3 | 3.5 |

| U.S. MBS | 1.5 | 4.8 |

| U.S. Corp High Yield | 1.6 | 8 |

| Global Aggregate (USD) | 1.7 | 3.6 |

| Emerging Markets (USD) | 1.8 | 8.2 |

| Morningstar/LSTA |

|

|

| Leveraged Loan | 0.7 | 6.5 |

| Alternatives | September 2024 | Year to Date 2024 |

|---|---|---|

| Bloomberg Commodity | 4.9 | 5.9 |

| S&P GSCI | -0.1 | 5.2 |

Sources: Standard & Poor's, Bloomberg, MSCI and Russell

The S&P indices are a product of S&P Dow Jones Indices, LLC and/or its affiliates (collectively, “S&P Dow Jones”) and has been licensed for use by Segal Marco Advisors. ©2024 S&P Dow Jones Indices, LLC a division of S&P Global Inc. and/or its affiliates. All rights reserved. Please see www.spdji.com for additional information about trademarks and limitations of liability.

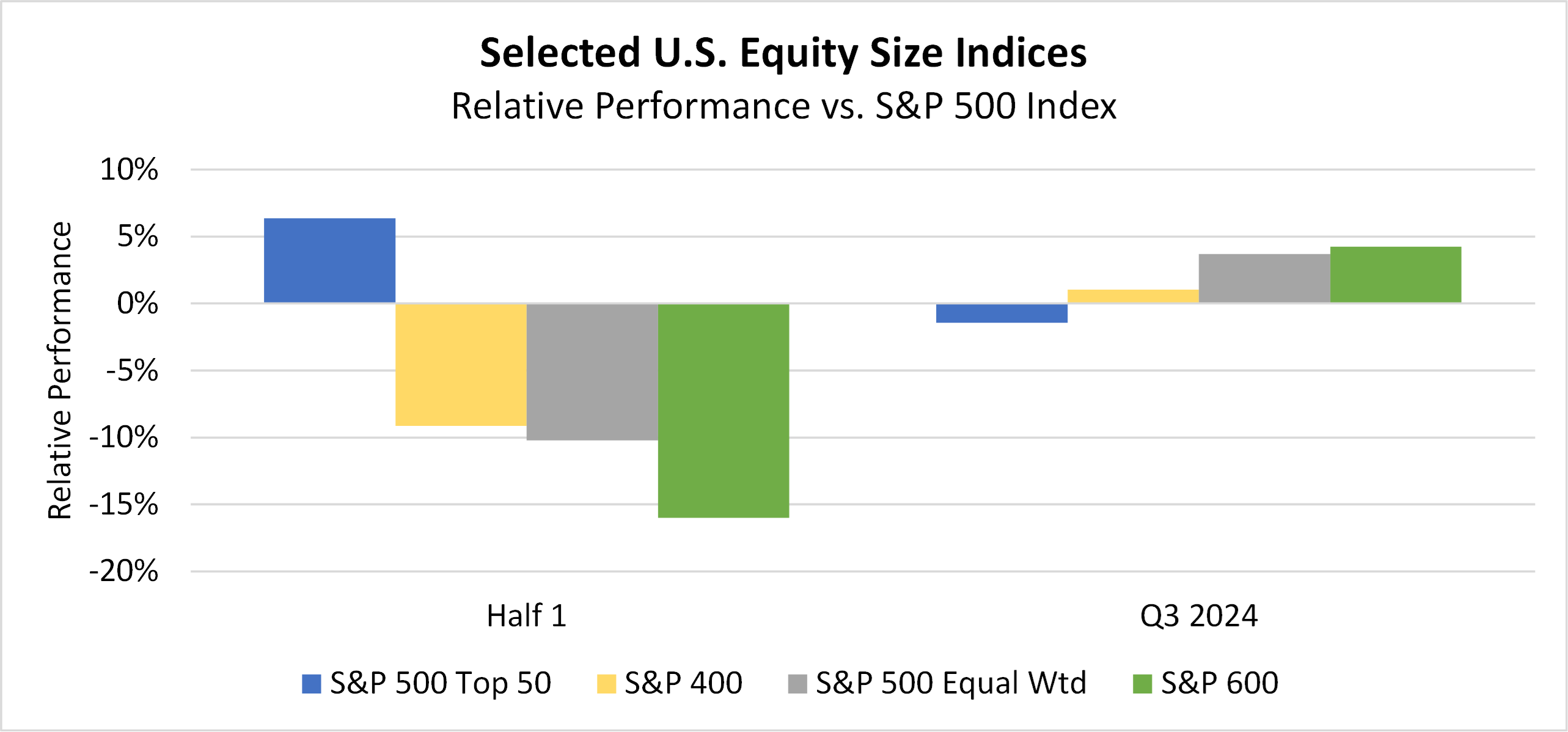

Equity markets

A rotation from the largest capitalization, growth/tech-dominated stocks continued through September quarter end, resulting in small cap stocks outperforming large cap stocks for the quarter (S&P 500, 5.9 percent, Russell 2000, 9.3 percent), although they did slightly underperform for the month of September (S&P 500, 2.1 percent, Russell 2000, 0.7 percent). Value stocks have also made up ground versus growth stocks, outperforming in the quarter (Russell 1000 Growth, 3.2 percent, Russell 1000 Value, 9.4 percent), but again lagged in the month of September, after the Federal Reserve rate cut put wind in the sails of the growth stock story (Russell 1000 Growth, 2.8 percent, Russell 1000 Value, 1.4 percent). As you can see in the chart below, the diversification of returns away from the largest stocks in favor of the equal weighted indices and smaller companies is now evident.

Source: FactSet

Outside of the U.S., the market-moving news was the People’s Bank of China (PBOC) announcement of a hefty stimulus package, including policy-easing measures, lending support for real estate, equities and consumption (the consumer). Following the news, the Chinese equity market rallied, returning 23.9 percent in the month of September and propelling emerging markets to the top-performing equity index for the month and quarter (6.7 percent for the month and 8.7 percent for the quarter).

Fixed income:

With the Federal Reserve’s interest rate cut, longer duration fixed income was the winner in both the quarter and the month ended September (Bloomberg Long Government/Credit Index, 8.0 percent, Bloomberg Aggregate Index, 5.3 percent for the quarter and 2.3 percent, and 1.4 respectively, for the month). All fixed income was positive in the month and the quarter, with shorter duration fixed income and leveraged loans lagging, as would be expected following a rate cut.

Looking ahead:

The U.S. stock market year to date is up 22.1 percent, and the bond market is up 4.5 percent. The stock market has performed above reasonable expectations across most sectors and regions and valuations are generally not considered cheap, except selectively overseas and small cap (although the valuations have become richer with the recent rally). Bonds have finally been positive contributors to the total portfolio return, with credit spreads low relative to historical averages.

We enter the fall with the election just ahead of us, geopolitical risk in the Middle East on the rise and Ukraine still hanging in the balance. Staying disciplined to policy and rebalancing towards long term targets remains a prudent path.

See more insights

Mid-Year Market Outlook: Rotation or More of the Same?

August 2024: The Rollercoaster

Waiting for Godot: The Fed Cuts Interest Rates

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.