Articles | February 25, 2025

Q4 2024 Investment Market Update

The final quarter of 2024 ended with mostly positive returns across major asset classes, although there was a significant difference among various regions. After presenting a brief overview of the global economy, this market update covers Canadian, U.S. and international equity markets, as well as fixed income performance.

Overview of the global economy

With inflation cooling and slower economic activities, inflation was no longer the markets’ primary focus and central banks continued to cut rates. The geopolitical turmoil in the Middle East persisted and a between Russia and Ukraine experienced escalations one after another, with more western military aid, North Korean involvement and suffering on both sides for almost three years.

November’s U.S. election was seen as a clear vote for change, delivering a Republican sweep of the White House and both Houses of Congress. Yet, relative to other major developed countries, the U.S. economy enjoyed much higher growth and U.S. real standards of living (measured by per capita real GDP) have outperformed nearly all OECD countries even after inflation adjustments. The U.S. had the best returns in Q4.

Other regions, including Asia, Canada, China, Europe and Mexico, were more in need of change. Europe had the worst returns in Q4. Get ready for a potential global trade war planned by President Trump.

The MSCI World Index gained 6.4 percent for the quarter and 30.0 percent for the year.

Canadian equity markets

The Canadian equity market advanced 3.8 percent for the fourth quarter of 2024, as measured by the S&P/TSX Composite Index, and returned 21.7 percent for the year. During the quarter, Canadian equity market results were mixed. The Financials sector outperformed, even with the setback of TD bank, whose $4.45 billion payment to the U.S. government was for its oversight failures on anti-money laundering. The Materials sector retreated, and the Energy sector was also relatively weak.

The Canadian economy is quite frail with slow growth, labour actions, weak consumer spending, a high cost of living and a job market that cannot keep pace with the population growth, which forced the government to declare a short sale-tax holiday for certain popular items. Political uncertainty highlighted in Ottawa at year end overshadowed any government economic initiatives. President Trump’s unexpected announcement on social media of potential tariffs of 25 percent on Canadian and Mexican imports in 2025 could be a significant economic headwind in 2025.

U.S. equity market

The decisive victory of President Donald Trump, whose policies are perceived as favourable for the U.S. economy, bolstered the U.S. equity market. It performed exceptionally well and returned 9.0 percent for the quarter and 36.4 percent for 2024, reaching record highs alongside the stable economy.

However, a brief setback in December’s equity rally was triggered by a shift in the Federal Reserve’s (Fed’s) monetary narrative, with a slower rate-cut path in 2025, preparing for the impact of President Trump’s implementation of his planned policies. The sector performance during the quarter was mixed: Energy, Materials and Healthcare retreated.

Overall, the U.S. economy closed the year in a stronger position than was anticipated early in the year; an expected recession resulted in a soft landing, aligning with optimistic projections.

International equity markets

International equity markets retreated and returned -2.1 percent for the quarter, as measured by MSCI EAFE Index, which returned 13.8 percent for the year. Within euro markets, economic growth remains very weak in Germany, France and Italy. Business activity in those euro powerhouses experienced a decline, as measured by the Purchasing Managers’ Index (PMI).

Japan had a positive stock market and returned 2.6 percent for the quarter and 18.1 percent for the year.

The emerging markets retreated by 2.1 percent during the quarter and returned 17.3 percent for the year. The China market retreated slightly for the quarter but performed strongly for the year at 26.8 percent, benefiting from strong exports and the government’s various support to the country’s sluggish consumer spending and weak housing market.

The Korean market was in turmoil, with political dramas and one of the worst aviation disasters during the quarter.

Fixed income performance

During the final quarter for 2024, we saw continued action of rate cuts by central banks, as both the Fed and European Central Bank announced two cuts of 25 basis points (bps) and the Bank of Canada executed two 50-bps cuts. With inflation rates easing, weak consumer spending and a slowing economy in most developed countries, monetary policy easing is at the center stage. The FTSE Canada Universe Bond index was flat for the quarter, and up 4.2 percent for the year. Higher-yielding corporate bonds, as measured by the FTSE Canada Corporate Bond Index, returned 1.0 percent for the quarter and 7.0 percent for the year, implying a positive credit spread on corporations. Canadian Real Return Bonds returned 0.3 percent for the quarter and 3.7 percent for the year.

The challenges for the Fed are high government spending, high global trade war risks and a positive job market. The Bloomberg Barclays U.S. Aggregate Bond Index was down 3.1 percent (USD) for the quarter and up 2.0 percent (USD) for the year, the Bloomberg Barclays U.S. Government Bond Index returned -3.1 percent (USD) and 1.5 percent (USD) for the year, and U.S. Corporate High Yield Index returned 0.2 percent (USD) for the quarter and 5.5 percent (USD) for the year.

Impact on a balanced portfolio

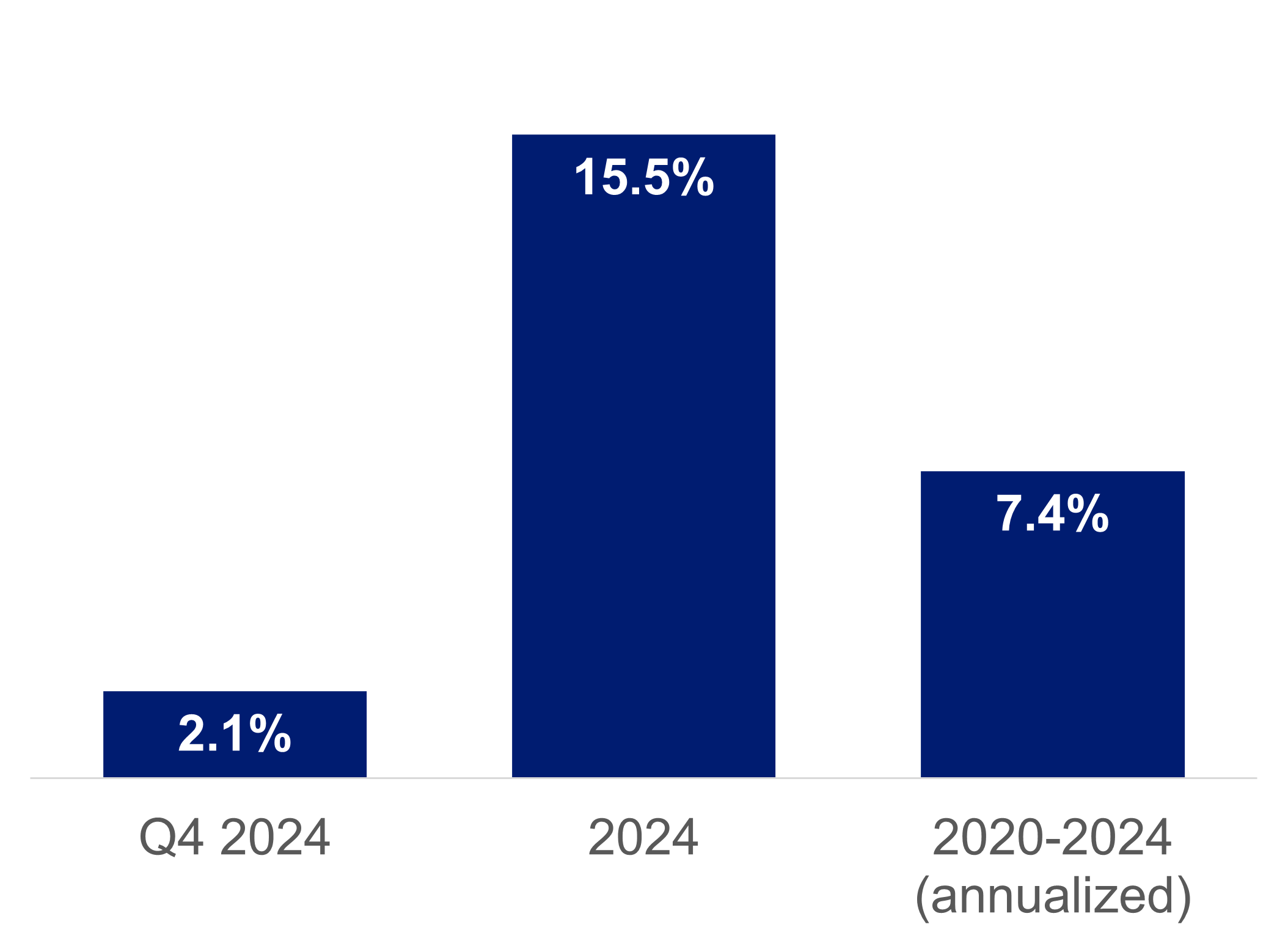

For a Canadian investor holding a balanced portfolio of 40 percent in Canadian bonds, and 20 percent in each of the Canadian, U.S. and international stock markets, here’s what the returns would have been for the quarter, the year and the past five years (annualized):

See more insights

Review of Markets 2024

December 2024 Financial Markets Recap: No Santa Claus Rally This Year

November 2024 Financial Markets Recap

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.