Markets were "Trumped"-up postelection and equities, in particular, greeted the news with positive results. Bond markets were a little more sanguine, amid skepticism on Federal debt, more rate cuts and inflation fears related to a new policy outlook.

| Equity | YTD (%) | MTD (%) |

|---|---|---|

| All Cap U.S. Stocks |

|

|

| Russell 3000 | 27.7 | 6.7 |

| Growth | 31.9 | 6.8 |

| Value | 22.4 | 6.5 |

| Large Cap U.S. Stocks |

|

|

| S&P 500® | 28.1 | 5.9 |

|

Russell 1000 |

28.1 | 6.4 |

| Growth | 32.2 | 6.5 |

| Value | 22.8 | 6.4 |

|

Mid Cap U.S. Stocks |

|

|

|

S&P 400 |

22.7 | 8.8 |

|

Russell Midcap |

24.1 | 8.8 |

| Growth | 30.2 | 13.3 |

| Value | 22 | 7.4 |

| Small Cap U.S. Stocks |

|

|

| S&P 600 | 18.1 | 10.9 |

| Russell 2000 | 21.6 | 11 |

| Growth | 25.4 | 12.3 |

| Value | 17.9 | 9.6 |

| International |

|

|

| MSCI EAFE NR (USD) | 6.2 | -0.6 |

| MSCI EAFE NR (LOC) | 10.8 | 0.6 |

| MSCI EM NR (USD) | 7.7 | -3.6 |

| MSCI EM NR (LOC) | 11.8 | -2.7 |

| Fixed Income | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg |

|

|

| U.S. Aggregate | 2.9 | 1.1 |

| U.S. Treasury: 1-3 Year | 3.8 | 0.3 |

| U.S. Treasury | 2.2 | 0.8 |

| U.S. Treasury Long | -1.2 | 1.8 |

| U.S. TIPS | 3.5 | 0.5 |

| U.S. Credit: 1-3 Year | 4.9 | 0.4 |

| U.S. Intermediate Credit | 4.8 | 0.8 |

| U.S. Credit | 4 | 1.3 |

| U.S. Intermediate G/C | 3.6 | 0.6 |

| U.S. Govt/Credit | 2.9 | 1 |

| U.S. Govt/Credit Long | 0.7 | 2 |

| U.S. MBS | 2.9 | 1.3 |

| U.S. Corp High Yield | 8.7 | 1.2 |

| Global Aggregate (USD) | 0.5 | 0.3 |

| Emerging Markets (USD) | 7.9 | 1.1 |

| Morningstar/LSTA |

|

|

| Leveraged Loan | 0 | 0 |

| Alternatives | YTD (%) | MTD (%) |

|---|---|---|

| Bloomberg Commodity | 4.3 | 0.4 |

| S&P GSCI | 5.8 | 0.1 |

Equity markets

With one of the strongest months in recent history, the declines in October were erased and then some in November. The market breadth also broadened in the month and, according to S&P, the top five stocks contributed only 1.3 percent to the S&P 500’s return of 5.9 percent in November. This 22 percent of contribution in November is in contrast to, for example, the top five stocks in June, contributing 67 percent of the total index return. Small cap stocks had their best month of the year (10.9 percent), and have been outperforming large cap stocks since June. Mid cap stocks followed suit (up 8.8 percent), whereas Non-U.S. stocks were all hurt post election. Both the stronger dollar and the potential outlook for tariffs hurt Developed Europe (EAFE -0.6 percent), and Emerging Markets (-3.6 percent).

Fixed income

Post election, interest rates rose with the 10-Year Treasury peaking at 4.36 percent and the 30-year Treasury bond at 4.61 percent (before ending the month at 4.10 percent and 4.36 percent respectively). By the end of the month, prices rose and yields declined enough to provide a slightly positive return of 1.1 percent for the Bloomberg Aggregate Index. Shorter maturity bonds held fairly steady during the month and ended up with a return of 0.3 percent for the 1–3-Year Treasury Index. The Credit sector also eked out positive returns with high yield and investment grade bonds returning 1.2 percent and 0.4 percent respectively.

Looking ahead

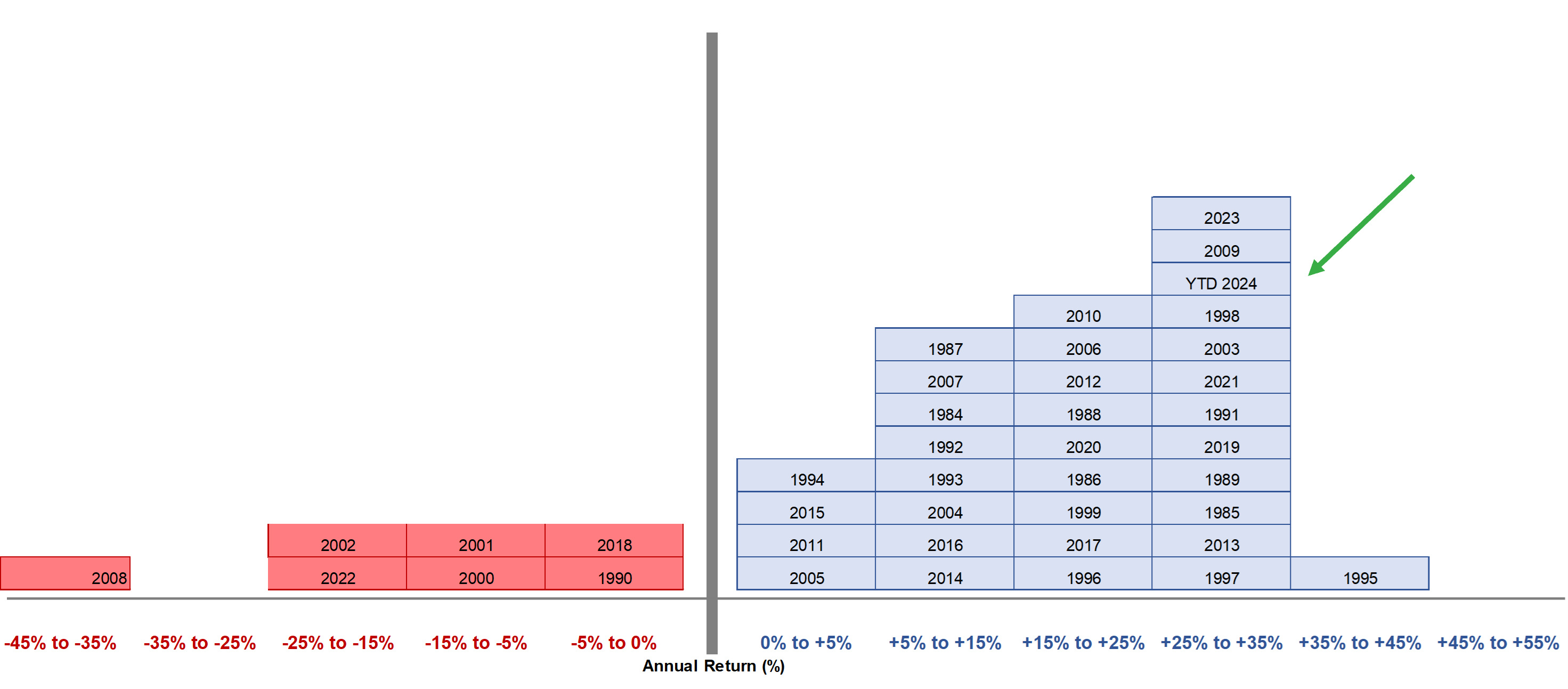

The histogram of the returns of the S&P 500 for the last forty years are outlined below. As you can see, 2023 and year to date 2024 rank in the higher end of the return range for the index. What should we think about that? With two strong years (almost) in the books, caution is advised. By caution, we mean that active rebalancing back to targets should be considered. There is a lot we don’t know about how the policy programs proposed during the election will or will not be put into effect. We do know that the markets are “optimistically” pricing in a lot of good news. That means if it does not come to pass, disappointment is the flip side of the coin.

The good news is that with only one month left in 2024, it’s shaping up to be a good year for financial markets, and we say “Thanksgiving” to that.

See more insights

November 2025 Financial Markets

BridgePort and Segal Marco Advisors Bring Digital Innovation to Private Investment Diligence

The Sun Rises on the Government Shutdown

The information and opinions herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This article and the data and analysis herein is intended for general education only and not as investment advice. It is not intended for use as a basis for investment decisions, nor should it be construed as advice designed to meet the needs of any particular investor. On all matters involving legal interpretations and regulatory issues, investors should consult legal counsel.